Ride to work.

For less.

32-63% offset on any bike.

Workride is New Zealand’s ride to work benefit program designed to help businesses get their employees riding to work and living healthier lives.

What is the Workride offset? - Click here to learn more.

*Offset range applies to employees earning over $53,501 annually, with a valid salary sacrifice with their employer, and based on the retailer’s quoted price to Workride which may include retailer surcharge.

Ride to work benefit fringe benefit FBT exemption electric bikes and e-bikes. Tax saving New Zealand Workride benefit scheme. Employee

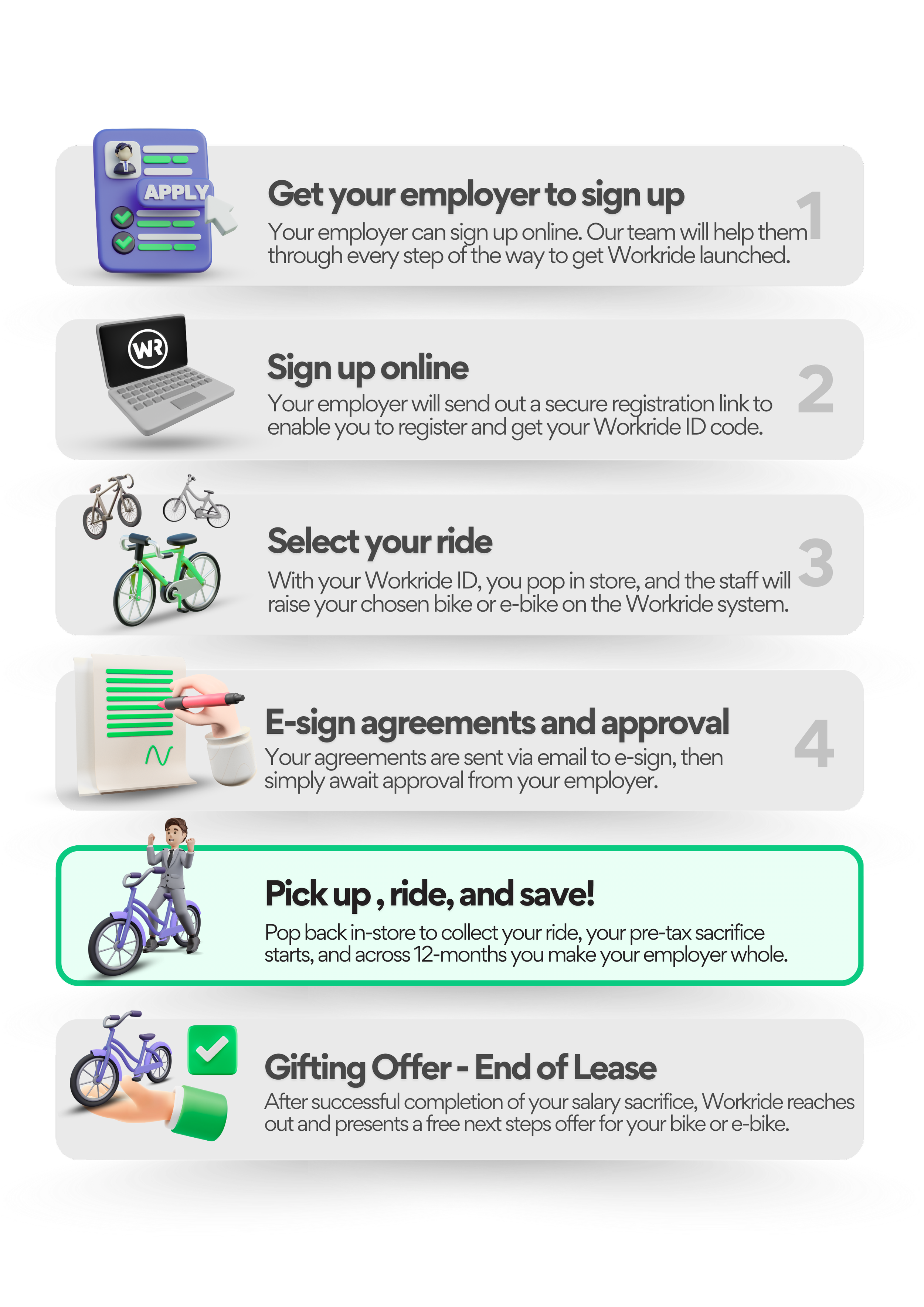

How Workride works for employees

1

Employer registration & online sign up.

Get your employer to sign up for free online today. Your employer will then send out a secure registration link to enable you to register and get your Workride ID code.

2

Choose any bike from any store.

With your Workride ID, you pop into any participating store, and the staff will raise your chosen bike or e-bike on the Workride system.

3

Workride’s digital process.

Your agreements are sent via email to e-sign, then simply await approval from your employer. Once approved, Workride releases a pick up code for secure collection.

4

Pick up, ride, & save!

With the pick up code pop back in-store to collect your ride, your pre-tax sacrifice starts, and across 12-months you make your employer whole. Due to Workride happening pre-tax you save big due to tax benefits.

Employees exchange (salary sacrifice) part of their pre-tax salary for a bike, e-bike, or scooter benefit of their choice from any participating store—no upfront cost.

The cost is spread across 12 months, with offsets between 32-63% off the retailer’s quoted price when selling to Workride, thanks to the pre-tax salary sacrifice and tax benefits.

After the 12-month period, Workride directly reaches out to discuss your options including the free gifting option to own the bike, e-bike, or scooter through a gifting process.

Choose your ride from 250+ retail and independent bike shops nationwide.

my employer is registered with workride. ✔️

I am ready to begin my benefit application. ✔️

check your savings.

Use our free online savings estimator to see the impact of Workride for you.

Cost offsets range from 32-63% off the retailer’s quoted price to Workride, determined by your personal income situation.

easy steps.

Your dream bike with a 32-63% offset is only a few steps away. Get your employer on board and enjoy riding for less with Workride.

Then simply register online and then pop in store, we take care of the rest.

refer your employer today.

Enter your details to receive our free information pack and kick off the discussion with your employer today. What do you have to lose?

New Zealand bike to work or cycle to work scheme for employees, employer and workplaces.

All round care.

Thanks to our partners, you can optimally access full insurance cover & roadside assistance if they don’t have any cover already. Meaning complete efficiency in cover.

Supporting organisations:

sign up.

Employers sign up with Workride and offer this benefit to their staff. It's a great way for employers to engage with and support their team.

choose your new ride.

Once an employer is on board, employees can pick out a bike, e-bike, or scooter for their commute from a list of 260+ stores that partner with Workride.

The ride must meet Workride regulations to ensure tax compliance for your employer. Check out examples and the regulations here.

ride & save.

Over a 12-month period, you can use the new ride to commute to work while the pre-tax salary sacrifice effectively reimburses your employer in full.

With Workride employees reduce their tax bill through a combination of PAYE and ACC levy.

Next steps.

After the initial 12-month period, Workride can discuss with you directly about the Next steps if you want to keep or return your bike for free.

Free Gift (Next Steps Deed): This option allows the individual to keep their bike, e-bike, or scooter as a gift from Workride for free.

employee FAQs.

Have a question that isn’t answered here?

Contact us by click the button below.

-

If you depart your job within the 12-month lease term, by default you will settle your outstanding salary sacrifice commitments with your employer through either residual final net pay or directly from a top up.

This action is consistent with the early termination provision in the Workride lease agreement. Your end-of-use options will only be presented once this repayment is confirmed by your employer.

-

Workride uses a 'salary sacrifice' approach. You divert a portion of your pre-tax salary towards a benefit, like a bike or scooter. This means you're taxed on a reduced salary, leading to direct Income Tax savings. Additionally, this setup impacts your KiwiSaver and student loan contributions. So, while these aren't tax savings, they reduce your out-of-pocket expenses. In total, Workride offers tax savings and restructures your earnings to make getting a new ride more affordable.

-

Transferring ownership of equipment (like a bike) at the start of a program introduces risks that could affect both employers and employees. Here's why an initial lease is essential and beneficial for everyone:

Protection Against Payment Issues

If an employee faces unforeseen circumstances or cannot complete their payments, the lease structure ensures a manageable process for resolving the situation. This protects both the employee from financial strain and the employer from bearing the full cost.

Avoiding Tax Complications

Immediate ownership can trigger Fringe Benefit Tax (FBT) and other compliance issues, which could lead to higher costs or even penalties. The lease structure ensures the program remains tax-compliant and avoids these complications for all parties.

Accountability and Retention Benefits

Retaining ownership during the lease period encourages accountability and creates an incentive for employees to remain with their employer until the program is completed. This benefits employees by fostering a mutually supportive relationship with their workplace.

Sustainable Program for All

The lease approach ensures the program remains financially sustainable and operationally efficient, allowing more employees to benefit in the long run. Without these safeguards, the program’s availability and success could be jeopardized.

-

The quoted ride price is the amount Workride pays for your chosen ride from our retail partners. The retailer may add a surcharge of up to 5% on all ride orders which is included in the quoted ride price. This surcharge ensures all bikes and e-bikes in-store can be sold sustainably through Workride.

Once instore please let the team know you are using Workride, this ensures the best sales experience.

-

Contact HR: Start by reaching out to your company's HR department. They should be able to confirm if the company is registered and provide you with the company password that was issued during the onboarding process.

Check for Registration Confirmation: If your HR department is unsure, they can check their records for an onboarding email from Workride, which would confirm their registration status.

Express Interest: In case your employer is not yet registered, this is an excellent opportunity to express your interest in having Workride as a benefit.

-

The cost and savings through Workride will vary based on your individual circumstances, such as your income, KiwiSaver contributions, and student loan details. To get a tailored idea of your potential tax savings, use our online estimator. Remember, it's not just about tax savings. With Workride, a portion of your income is also redirected towards your chosen ride, softening the blow to your wallet. Dive into the estimator and see how much you could benefit!

-

The "Workride Cost Offset" is the unique advantage you get when acquiring a ride through the Workride scheme. It essentially represents the difference between the regular retail price versus the impact your take-home pay. Simply put, take the price given by the retailer and subtract the Workride Cost Offset to see the true out-of-pocket effect on your income. It's a smart way to make your ride more affordable without feeling the full pinch on your paycheck.

-

The "Workride Offset" breaks down into two main components: tax savings and the smart use of your income. When you join the Workride scheme, you sacrifice a portion of your pre-tax salary for your chosen ride. This action reduces your taxable income, so you end up paying less tax overall. Furthermore, the money that used to go towards other financial commitments, like KiwiSaver or student loans, is now assisting in covering the cost of your ride. Together, these factors create a sensation of getting a significant discount on your ride's retail price, making the whole process feel much lighter on your wallet. This combined benefit is what we term the Workride Offset.

-

By choosing a new ride through Workride, you're essentially swapping out taxed income for a new ride. The cost of the ride is taken from your pre-tax salary, which lowers your taxable income. With a lower taxable income, you pay less in income tax (PAYE) and ACC Levy, creating tax savings for you.

Instead of paying tax, and then buying a ride with what's left, we help you remove the tax step altogether meaning a lower cost to you!

-

Most contents insurance policies cover items that you or your family own or are legally responsible for. This can include items in your possession through arrangements like a 12-month consumer lease from a service provider. These policies generally define "contents" as:

"Household goods and personal effects that you or your family own or are legally responsible for."

Under this definition, a leased bike would typically be covered, as you are legally responsible for it during the lease period. Additionally, many contents policies provide coverage for items temporarily away from your home, ensuring protection for leased items like a bike when in transit or stored elsewhere. Always refer to your specific policy wording for confirmation.

Workride strongly encourages employees to obtain adequate cover for their ride to safeguard against damage or theft. Employees should simply notify their contents insurance provider about the replacement value of their ride. -

With Workride, there isn't a fixed spending cap for choosing your ideal bike. We want to ensure you have the flexibility to select the best bike to enhance your commute. However, it's essential to note that some employers might set a limit due to cash flow considerations and to ensure the scheme remains accessible to all employees. Always check with your employer for specific guidelines.

-

Certainly! You're eligible to join the Workride scheme if your employer is registered with us, you receive your income through PAYE, and you're a New Zealand tax resident. Just ensure you choose your ride from one of our approved retailers.

-

Once your lease finishes, Workride will engage with you directly to present and discuss your ‘Next Steps’ options regarding ride equipment ownership options. It's worth noting that during the lease, you hold legal possession but not ownership of the ride..

-

With Workride, you have access to an extensive network of approved retailers,If you've already picked out your desired ride, simply visit your preferred approved store and provide them with your customer code to place an order. For a handy reference, check out our store map on our website to locate the nearest participating retailers. If your local shop isn't part of our network yet, they can easily join Workride, expanding our community and giving you even more options.

-

Certainly! Any bike shop can join Workride and become an approved store. Stores can sign up on our retailer page to begin their Workride retail partnership journey.

-

Through Workride, you have the freedom to choose what keeps you moving! This includes any bike, e-bike, scooter, and e-scooter that retailer are currently selling! Just make sure your choice is classified as a mobility device and not a motor vehicle under current legislation. Remember, as regulations change, the options available might too. But don't worry, we'll always keep you updated on the latest choices available.

-

Before collecting your ride from the retailer, you have the option to cancel your order. If you wish to exchange for a different ride, this decision must also be made before pickup. In such a case, we will need to return to the quoting step with your employer to adjust the details. Once you've picked up your ride and the lease period has started, neither refunds nor exchanges will be permitted. Ensure you're confident in your choice before beginning the lease period.

-

Yes, your ride is covered by all standard warranties. In accordance with the Consumer Guarantees Act 1993, the retailer ensures that all equipment, including your ride, meets the quality and standards as if it was sold directly to you as a consumer. This means you receive all the rights, guarantees, and warranties associated with your ride, including the right to require repair or replacement of any defective item without any additional cost. If any issues arise, you can make a claim in line with these guarantees and warranties.

-

Absolutely not! While the scheme is designed to promote cycling to work, there's no obligation to ride every single day. Just ensure your bike is primarily used for commuting to, and possibly between, workplaces. Whether you cycle daily, weekly, or whenever suits you, the choice is yours.

-

The responsibility for maintaining the bike rests with you, the employee. Think of it as taking care of something you will own one day. However, for warranty claims or specific concerns, you can always approach the local WorkRide-approved retail store where you collected your ride. They're there to assist and make the journey smoother for you!

-

Certainly, you can participate even if you're on wages. However, there are some practical considerations to be aware of. Especially for those on zero-hours contracts where there isn't a guaranteed set of working hours, there might be periods without earnings. This can make the salary sacrifice aspect challenging because, without a consistent salary, the employer might find it difficult to recover their costs. So, while it's possible, you'll need approval from your employer to ensure the arrangement is feasible for both parties.

Let your employer know you want workride.

New Zealand bike to work or cycle to work scheme for employees, employer and workplaces.

we protect your employer.

Workride’s lease structure ensures employers can safely offer the benefit while fully recouping costs before ride ownership is offered to employees. Our compliant program shifts Health & Safety, Consumer Guarantees Act, and CCCFA obligations to Workride, eliminating employer and director risks as a service provider. It’s a seamless and the safest solution for your employer to empowering your commute. Read more on this in our FAQs.

how do you save?

Workride operates on a " valid salary sacrifice" model, where employees sacrifice part of their pre-tax salary for a chosen ride.

Over 12-months employees will have reduced take-home pay while they effectively reimburse the cost to employers.

normal journey.

using workride.

arrangement.

Workride streamlines the legal and tax documentation process digitally, ensuring compliance for all parties involved. Employers cover the initial cost of the benefits service, while employees opt into a salary sacrifice, making this benefit provision cost-neutral for the employer.

worked example.

Workride operates on a "salary sacrifice" model, where employees opt to reduce their pre-tax salary to lease a bike or scooter. In addition to the tax savings, a small proportion of other contributions like student loans or Kiwisaver may also be redirected towards the ride, depending on its value. After the 12-month lease of your ride equipment, you will receive an email directly from Workride outlining your ‘Next steps’ options regarding ownership of the ride equipment.

For example, an employee with a $85,000 salary, 4% Kiwisaver, and Student loan, chooses a Trek Powerfly FS valued at $6380, but it’s on sale in-store at $5200.

Through Workride, they salary sacrifice $100 pre-tax and their weekly take-home pay impact is only reduced by $49, totalling an annual net contribution of only $2569 towards the ride. This arrangement benefits both the employee and employer, offering tax savings and financial flexibility.

Choose any ride.

That’s right! You can can choose any ride that best suits your commuting needs.

Check out the details below to get up to speed with what rides are eligible for the WorkRide benefit scheme. This guide is in line with the guidance and regulations from the NZ Government, IRD, and Waka Kotahi.

-

Any bike that is suited for your commuting needs.

-

Any electric bike that the combined maximum power output of the electric auxiliary propulsion motors does not exceed 300 Watts, and is best suited for your commuting needs.

Waka Kotahi Low Powered Vehicle Info -

Any e-scooter that has wheels smaller than 355mm in diameter, and that the combined maximum power output of the electric auxiliary propulsion motors does not exceed 300 Watts.

Waka Kotahi Low Powered Vehicle Info -

The intent of this scheme is to enable access to ride hardware that allows the employee to ride to and from work. It is noted that their will be some incidental personal use, which is perfectly fine due to the health and active transport benefits for NZ.

-

Workride carries out a regulation check on every ride benefit raised to ensure fair use and compliance on the above guidelines.

workride is New Zealand’s complete ride-to-work benefit solution.

Join the waitlist for our public transport ride to work benefit program today!

Listen or read more about Workride:

Want to learn more?

Check out the following pages to learn more about workride.